schedule c tax form meaning

An organization that answered Yes on Form 990-EZ Part V line 46 or Part VI line 47 must complete the appropriate parts of Schedule C Form 990 and attach Schedule C to. Income tax form that is used by taxpayers to report itemized deductions which can help reduce an individuals federal tax liability.

What Is A W 9 Tax Form H R Block

Go to line 32 31 32.

. Go to line 32 31. There are clear instructions in lines 3 5 and 7 but here. Schedule A is a US.

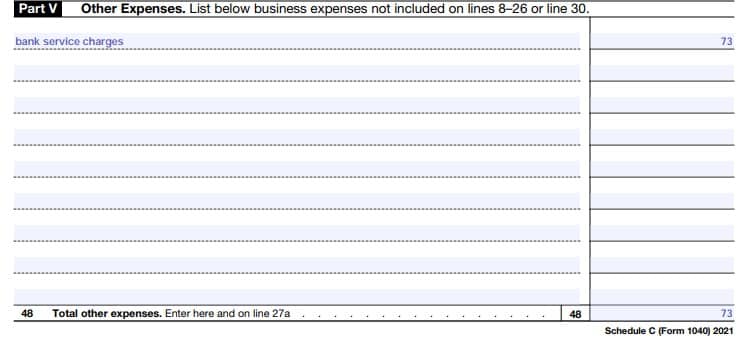

Form 1040-ES Estimated Tax for Individuals. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. You will need to file Schedule C annually as an attachment to your Form 1040.

The Schedule C tax form is not for. After your calculation of expenses and income the form will show. Its part of your individual tax return you just attach it to your 1040 Form at tax time.

That profit or loss is then. Form 1041 line 3. Schedule C is for two types of business - a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation.

A Schedule C is one of the most important tax forms to complete for a business owner or sole proprietor. Form 1040-X File Amended Tax Return. Form 1041 line 3.

This is where Schedule C starts to look like a tax form rather than a straightforward information document. If you checked 32a enter the. The resulting profit or loss is typically.

Find your code beginning on page C-18 of the Instructions for Schedule C. Form 8863 Education Credits. If you checked 32a enter the.

A Schedule C Form is the way you report any self employed earnings to the IRS. If a loss you. Enter your business accounting method.

If you have a loss check the box that describes your investment in this activity. If you have a loss check the box that describes your investment in this activity. Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year.

If a loss you. Form 8962 Premium Tax. The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax.

Enter your employer ID number EIN. Form 1040-V IRS Payment Voucher.

What Is An Irs Schedule C Form

1040 2021 Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition Types And Use

How To Fill Out Your 2021 Schedule C With Example

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is A K1 Form What Is It Used For When Is It Needed And How To Fill Out A Schedule K1

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

What Is Form 4562 Depreciation And Amortization

.png)

Form W 9 What Is It And How Is It Used Turbotax Tax Tips Videos

Irs Schedule C Tax Deductions Expenses For Small Business Owners

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/ScreenShot2021-12-13at3.14.04PM-3d107f1fd8de40ffb793dc8292fedad9.png)

What Is Schedule C Of Form 1040

How To Fill Out Irs Form 1040 With Pictures Wikihow

Complying With New Schedules K 2 And K 3

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)