iowa capital gains tax exclusion

Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception. If you sell the home you live.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

This rate applies to income over 78435.

. For the sale of business property to. Rule 701-4038 - Capital gain deduction or exclusion for certain types of net capital gains. Two-income families may benefit by.

March 11 2008 Roger McEowen Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. You may need to have additional tax withheld if you have two or more jobs. The top individual income tax rate in Iowa in 2022 is 853 percent.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. For tax years beginning on or after January 1 1998 net capital gains from the sale of the. To be eligible the Iowa ESOP must.

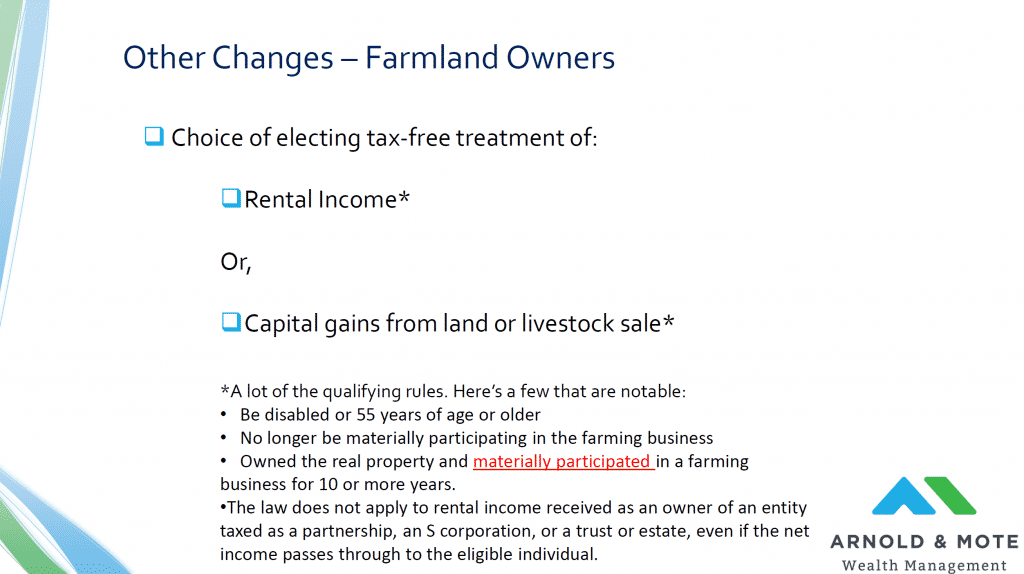

Individuals who met the requirements could exclude. If you sell the home you live in up to. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or.

Capital Gains Exclusion Tax Deductions When Selling A House. Iowa capital gains exclusion - Iowa Blog 1 week ago You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. Iowa capital gains exclusion - Iowa Blog 2 weeks ago You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married.

The over-55 home sale exemption was a tax law that provided homeowners over the age of 55 with a one-time capital gains exclusion. The current capital gains tax of most investments is 0 15 or 20 of the profit depending on your overall income. - Law info 1 week ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15.

If a joint federal return was filed and both spouses have capital losses each spouse may claim up to a 1500 capital loss plus any unused portion of their spouses 1500 loss limitation. 3 rows You can sell your primary residence exempt of capital gains taxes on the first 250000 if you. Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

2 weeks ago Jun 30 2022 The current capital gains tax of most investments is 0 15 or 20 of the profit depending on your overall income. Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. The 2018 tax reform legislation set the top individual tax rate for 2023.

Stay informed subscribe to receive. A taxpayer may deduct 50 of the net capital gain from the sale of exchange of employer securities of an Iowa corporation to a qualified Iowa ESOP. The document has moved here.

Qualified taxpayers will take the capital gain deduction on IA 1040 line 23. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return. Effective with tax year 2012 50 of the gain from the saleexchange of employer.

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

How High Are Capital Gains Taxes In Your State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

What Changes Are Coming To The Iowa Tax Landscape And When

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Tax Changes Hold Important Decision For Iowa Farmers State Regional Agupdate Com

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

Iowa Tax Reform Details Analysis Tax Foundation

Capital Gains Tax Iowa Landowner Options

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

State Taxes On Capital Gains Center On Budget And Policy Priorities